|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

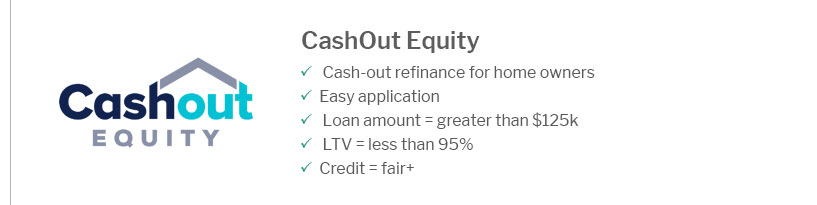

Understanding Home Addition Loans: Key Features and HighlightsHome addition loans can be a practical solution for homeowners looking to expand their living space. Whether you want to add a new room, build a garage, or enhance your home's overall functionality, these loans offer a way to finance the project without draining your savings. Types of Home Addition LoansThere are several types of home addition loans available, each with its unique benefits and considerations. Home Equity LoansHome equity loans allow you to borrow against the equity you've built up in your home. These loans typically come with a fixed interest rate, making it easier to budget your monthly payments. It's important to compare different rates to find the best option, such as those found at apr house loan. Personal LoansPersonal loans can be used for home additions if you prefer not to use your home as collateral. These loans often have higher interest rates but can be obtained quickly, making them a viable option for smaller projects. Cash-Out RefinanceThis option involves refinancing your current mortgage for more than you owe and taking the difference in cash. It can be a good choice if you can secure lower jumbo arm refinance rates compared to your existing mortgage. Benefits of Home Addition Loans

Factors to Consider

FAQs About Home Addition LoansWhat credit score do I need for a home addition loan?Most lenders prefer a credit score of 620 or higher, though requirements can vary. Can I use a home addition loan for any type of renovation?Generally, yes. However, it's best to check with your lender as some may have restrictions. How does a home addition loan affect my mortgage?It depends on the type of loan. A cash-out refinance, for example, will replace your existing mortgage with a new one. https://www.usbank.com/financialiq/manage-your-household/home-ownership/how-to-finance-home-addition.html

Home equity line of credit. Often called HELOC, this type of financing can be a first or second mortgage that taps into the equity you've earned. - Home equity ... https://www.wellsfargo.com/personal-loans/home-improvement/

With a home improvement loan from Wells Fargo, borrowers are able to complete their home renovation project with a fixed-interest rate personal loan. We offer ... https://www.reddit.com/r/HomeImprovement/comments/r47cjr/getting_a_loan_for_an_addition/

An arguably better option is to fund the addition with a home equity loan or cash-out refinance you can get the money up front and the ...

|

|---|